Loan Processing

Our team of skilled and experienced loan processors are experts in the industry, ensuring accuracy and efficiency at every step. We understand the critical importance of precise and timely processing, and we are dedicated to delivering the highest level of service to our clients.

By working hand-in-hand with credit bureaus and lenders, we ensure all necessary documentation is gathered and processed promptly. Additionally, we diligently track the status of each loan throughout the process, keeping our clients consistently updated on their progress.

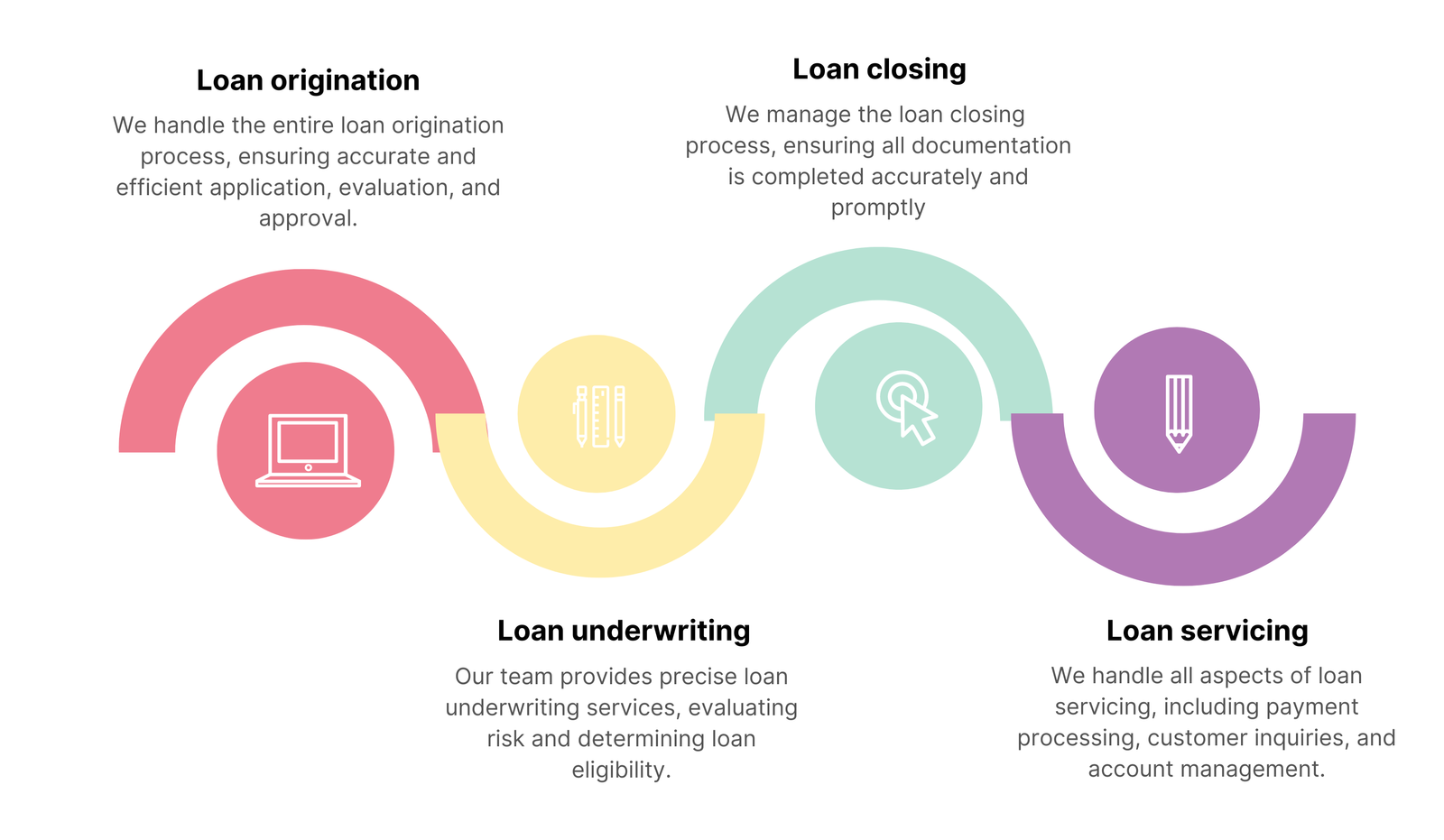

we offer a veriety of loan processing services

Here are some of the benefits of outsourcing your loan processing to us:

Save time and money

Outsourcing your loan processing allows your staff to focus on other important tasks, such as sales and marketing, which can result in significant time and cost savings.

Improve accuracy

Our seasoned loan processors are experts in the industry, committed to delivering accurate and efficient service, helping you avoid costly mistakes.

Increase efficiency

By outsourcing your loan processing, you can streamline the entire process, leading to faster turnaround times and enhanced customer satisfaction.

Gain access to specialized expertise

Our team possesses technical expertise in various areas, including loan origination, underwriting, and closing, ensuring that you secure the best possible loan terms for your clients.

Our Approach To Loan Processing BPO

Faster loan processing time should always be the goal when you are outsourcing.

The loan processing BPO greatly reduced the loan duration process by eliminating steps that software can do. Accuracy is almost 100% because the computer will analyze all the data you need to process. Besides that, our mortgage resource specialist undergoes several training to prepare them for the loan processing industry. Here’s how we do it :

- We will hire people based on the criteria that you will give to us.

- We will present the candidates and let you choose the best agent for your team with our guidance.

- We will onboard them once they’ve done industry-specific training together with their quality assurance supervisor to monitor their performance in accordance with your KPI.

Neo Entrust formula to success is top-of-the-line technology and skilled agents for your loan BPO.